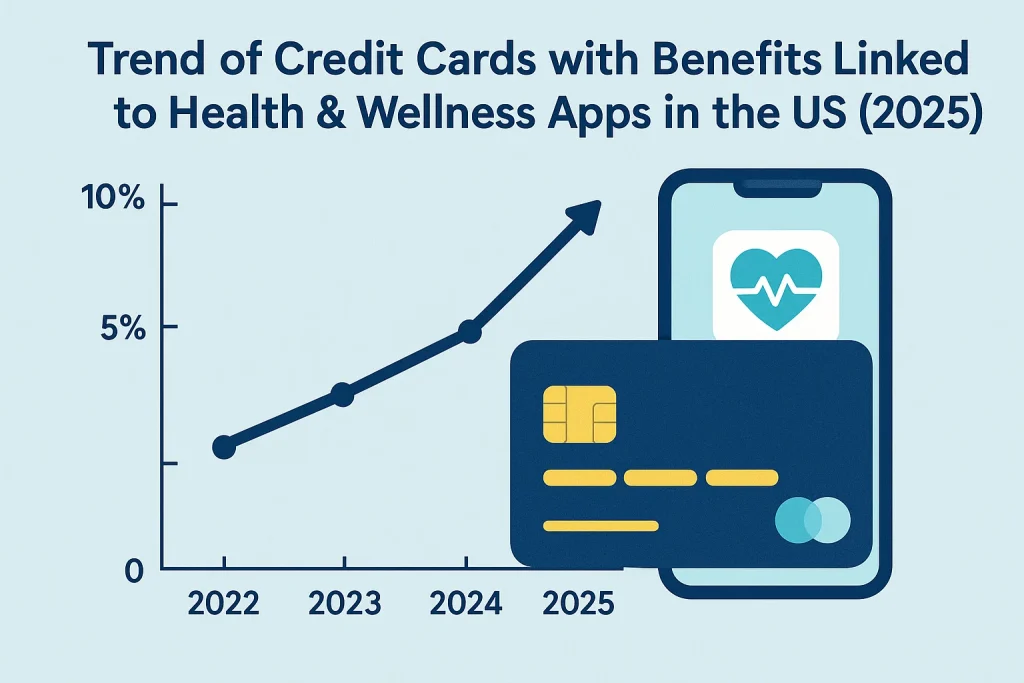

In recent years, credit cards have evolved beyond simple payment tools, integrating a variety of perks aimed at improving the lifestyle and wellness of their users. With the rise of health-conscious consumers, credit cards are now offering benefits linked to health and wellness apps in the United States. This trend reflects the changing priorities of cardholders who are increasingly interested in maintaining a healthy lifestyle through fitness and well-being incentives.

The growing interest in personal health has led financial institutions to reconsider their offerings. The integration of wellness benefits with credit cards is not only attracting new customers but also fostering loyalty among existing clients. As we delve deeper into this trend, we will explore what makes these incentives so popular and how they can benefit consumers.

Advantages of health-related incentives in credit cards

The principal advantage of incorporating wellness benefits into credit cards is the appeal it holds for health-conscious consumers. These incentives often include gym membership discounts, subscriptions to fitness apps, or cashback on eligible health-related purchases.

This strategy is particularly effective among millennials and Gen Z, who prioritize holistic well-being. The allure of receiving tangible rewards for partaking in activities that promote physical health ensures that users remain engaged and motivated. Moreover, such benefits help cardholders offset expenses associated with maintaining their well-being.

How credit card companies are implementing health benefits

Credit card companies are leveraging partnerships with popular health and wellness brands to enhance their offerings. By collaborating with fitness apps like Peloton, Calm, or Headspace, they provide added value to their cardholders. These collaborations often include exclusive discounts or complimentary trials, making it easier for users to access premium services without added costs.

Furthermore, some financial institutions are integrating health rewards programs directly into their apps, enabling cardholders to track and redeem points for various health-related purchases. This seamless integration encourages users to make healthier lifestyle choices while simultaneously enjoying the convenience of their credit card features.

How consumers can leverage these health-related rewards

Those holding credit cards with health-related rewards can maximize their benefits by strategically planning their usage. By aligning their everyday expenses with available incentives, consumers can accrue significant savings. For instance, purchasing gym gear or signing up for wellness classes through channels that offer cashback or discounts can result in noticeable financial benefits over time.

Another practical approach is making use of free trials or discounted subscriptions to sample different fitness or mindfulness apps, ultimately selecting those that best fit individual health goals. Furthermore, by staying informed about new offers and updates from their credit card provider, consumers can continue to benefit from relevant and timely incentives.

Practical steps to take advantage of health-related credit card perks

Start by reviewing the benefits associated with your current credit card. Take note of any health and wellness perks it provides. Next, adjust your spending habits to align with these benefits, such as using your card for eligible health service purchases. Consider setting spending alerts via your card’s app to maximize rewards efficiently without exceeding your budget.

Additionally, periodically check your card issuer’s website or app for the latest updates and offers. Many companies periodically update rewards programs to reflect consumer preferences. These efforts ensure you never miss an opportunity to further your wellness journey while enjoying the accompanying financial benefits.

Final thoughts on the trend driving credit card innovations

The incorporation of health and wellness benefits into credit cards represents a symbiotic relationship between financial institutions and their users, emphasizing a commitment to consumer well-being. As this trend continues, we are likely to witness even more innovative partnerships and rewards tailored to health-conscious users.

For consumers, these developments present an opportunity to integrate financial management with a proactive approach to their health. By understanding and utilizing the available rewards, cardholders can enjoy not only the monetary perks but also the enhanced quality of life that comes with investing in their wellness journey.