In today’s digital era, safeguarding your credit cards is more essential than ever, especially with the rise of deepfake and AI scams. The sophistication of these fraudulent techniques is increasing, making it vital for consumers to stay informed and vigilant.

Deepfake and AI scams often mimic voices or create highly realistic videos to deceive individuals into sharing sensitive information. Understanding how these threats operate and learning to recognize them is crucial in preventing financial mishaps. Awareness and proactive measures can significantly reduce your vulnerability to such modern scams.

Understanding deepfake and AI scams

The world of deepfake and AI frauds is evolving at a rapid pace. These scams use artificial intelligence to create fake images, videos, or audio recordings that impersonate trusted sources. For instance, cybercriminals might create a realistic voice simulation of a bank official instructing you to verify your credit card details.

As these synthetic media become more convincing, identifying them requires a sharp eye. Always be suspicious of unsolicited requests for personal information and verify any communication directly through official channels before taking action.

Recognize the warning signs

Spotting a deepfake or AI-generated scam can be challenging but not impossible. Pay attention to any anomalies like unnatural facial movements or audio inconsistencies in videos or calls. Scammers often use pressure tactics to rush you into making hasty decisions.

If something feels off or too urgent, it’s a red flag. Stay informed about the latest scam trends by regularly checking news updates or subscribing to alerts from consumer protection agencies. Empower yourself with knowledge about these scams to better protect your financial assets.

Implementing security measures

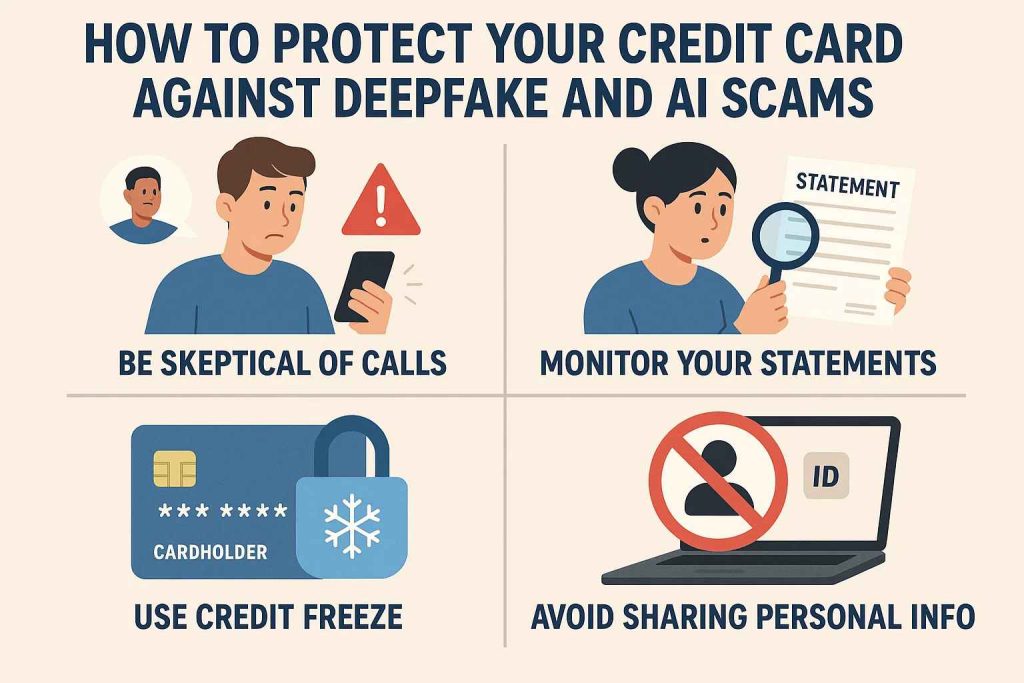

Strengthening your defenses is key to preventing unauthorized access to your financial information. Utilize robust security tools such as two-factor authentication and keep your devices secured with up-to-date antivirus software. Avoid storing sensitive credit card information on unsecured websites or devices.

Encrypt important data and be mindful of the apps you download, ensuring they are from reputable sources. Consider setting up transaction alerts on your phone or through your bank’s app to stay immediately informed of any suspicious activity. This proactive stance can help you act swiftly in case of any potential breach.

Practical steps to enhance security

To effectively minimize risks, regularly update your passwords and avoid using the same one across multiple sites. Use complex combinations of letters, numbers, and symbols to create strong passwords. Educate yourself and your family members about common scam tactics to ensure everyone is prepared to identify potential threats.

Routinely check your financial statements for unforeseen charges and report any discrepancies to your bank promptly. Additionally, implement credit freezes or fraud alerts with major credit bureaus to add an extra layer of protection against identity theft.

Concluding thoughts on credit card security

In conclusion, staying ahead of deepfake and AI scams requires a combination of vigilance, education, and the implementation of robust security practices. By understanding the methods scammers use and recognizing the signs, you can take proactive steps to guard your financial information.

Regularly updating your knowledge and employing security protocols will enhance your protection against these sophisticated threats. As technology continues to advance, maintaining your financial security demands a dedicated effort to stay informed and prepared to tackle new challenges effectively.